Jon Spratt

That means that HR managers and leaders are facing some unique challenges in 2021; all revolving around how to best manage their workforce so they can deliver more value to their members.

To help meet the day-to-day tactical challenges of managing their people in this new reality, there

are some structural, strategic HR aspects that we’ve seen be a major help to credit union HR leaders trying to navigate their organizations through the new set of circumstances that we’re all facing.

The only constant is change

Before we get into some HR priorities for credit unions in 2021, let’s take a quick moment to reflect

on the extent of the changes that this past year has fostered.

- Remote work: The majority of people who are currently working at all are working from home. According to Stanford University economist Nicholas Bloom, “by sheer numbers, the U.S. is a

working-from-home economy. Almost twice as many employees are working from home as at work.” - Less opportunity for consistent feedback and development. Because of the new work-from-home world, those informal check-ins that used to be common have gone by the wayside.

- Culture challenges: Beyond those reduced development opportunities, it can be difficult to maintain your company’s culture, values, and team camaraderie that was more naturally fostered when working on site.

- Productivity questions: Some people report being more productive when working from home, while others have been struggling.

So, how can you address these things from an HR perspective? How can you play an important role in maintaining your company’s values, productivity, and development opportunities? Based on the radical shifts in what credit union HR professionals have faced in 2020, let’s tackle three big priorities for 2021.

Priority 1: Maintaining your company culture and values as your workforce is spread out.

Most who work in credit unions would agree: a big part of their appeal is the personal touch

that their members get, as compared to doing business with big banks.

In short, this attitude, personality, and member-first mindset boils down to company culture.

And while the pandemic continues to have a major impact on our world, our businesses and

our employees, competencies can play a huge role in maintaining those values that are the

hallmarks of your credit union.

It starts with core competencies — in this context, the behaviors that are embodied and

demonstrated by every employee in your credit union, to help drive your organization forward.

Core competencies turn those vision statements and often-abstract corporate values into measurable, on-the-job behaviors that an organization desires to implement within its workforce.

Want to start thinking about your credit union’s core competencies? Here’s a handy starter guide.

Taking competencies beyond the "core": how it works

Competencies can — and should — filter way down beyond the “core” level.

Many organizations make use of a “competency architecture”, which codifies the skills and behaviors demonstrated by everyone in the organization, specific to their role.

Job family competencies are used to apply the same competencies within a family of jobs, like sales, for example.

Below that, job-specific competencies are just what they sound like — competencies (behaviors and skills) required for success in specific, individual roles.

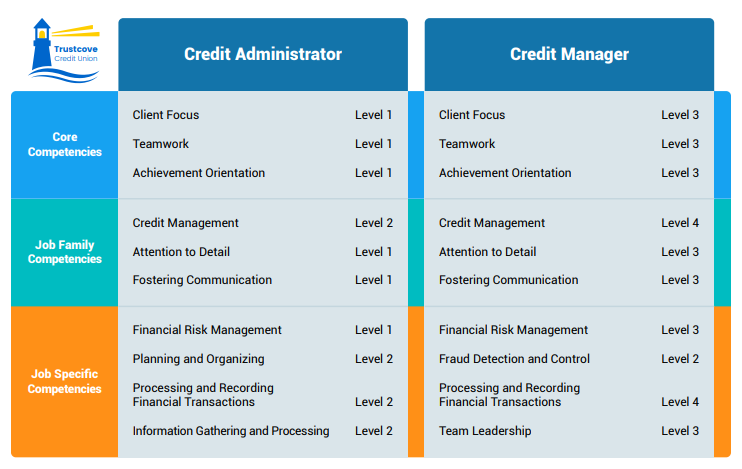

Here’s a quick look at two jobs in an example organization, Trustcove Credit Union: credit administrator, compared with credit manager. Take a look, and we'll explain below.

• The core competencies — those key values and behaviors in the organization that everyone should embody — are the same, though the required level may differ.

• The job family competencies — those competencies that apply to everyone working in the same group within the organization — are the same, though the required level may differ.

• The job specific competencies — those behaviors and skills that are specific to the unique job —

may be similar, but will usually differ in some way.

Priority 2: keeping everyone focused on doing their most important work during disruptive times.

It’s more important than ever for employees to have a clear understanding of their role and responsibilities.

With many credit unions forced to move to a largely dispersed, remote workforce, talent management personnel have had to quickly adapt to the new reality.

Let’s quickly think about some of the day-to-day impact this has had on employee workflow in the new normal.

• Employees who used to work in offices are no longer able to walk a few steps over to a colleague’s desk to ask them a quick question;

• junior employees have less opportunities to pick the brains of their more senior colleagues;

• managers have largely shifted to more formalized check-ins, instead of having more regular, informal feedback loops on a daily basis.

An updated record of an employee’s official responsibilities can be a great tool to keep them focused on the most important tasks/responsibilities they need to carry out, bigger picture, to be successful in their roles.

To take it a step further, including core competencies and job-family competencies on your job descriptions is an ideal way to ensure buy-in on the key values and behaviors needed to drive your organization, and its teams, forward.

In this new reality — with significantly less opportunity for “micro-check-ins” — clarity is king.

And rather suddenly, your company’s job descriptions — those oft-forgotten, static documents — become worth their weight in gold.

Job descriptions as a compliance tool

Of course, financial institutions face added scrutiny with employees working from home

with compliance requirements. In our recent research report, “The State of Job Descriptions

in 2020”, 43% of our respondents said that compliance was a driving factor in why they

create job descriptions in the first place.

Undoubtedly, that number is higher in the financial services sector.

Yes, compliant job descriptions require a consistent format and highly accurate content;

but it’s about more than just that.

It’s also about the paper-trail behind it: who was involved in determining the requirements,

how were they kept up-to-date, and whether employees acknowledged the accuracy of

their job description.

It’s a great time to revisit your company’s job descriptions. They’ve never been more

important, and the process of revisiting them can not only ensure that everyone’s reminded

of their core responsibilities, but also serve as a terrific re-engagement exercise with your

dispersed workforce.

Priority 3: keeping employees engaged and growing, even if they're not in the office

The number-one cause of employee dissatisfaction and turnover is the lack of opportunity for career advancement. Even in these unique times, employees want to know that there’s

a way forward for them in your organization.

You can show them the way by giving them tangible career paths that they can adjust and

work towards over time.

First Commerce Credit Union, a mid-sized regional credit union based in Florida, is taking

this approach with their employee career pathing program that they’re calling “Level Up.”

Donna Moran, culture champion at First Commerce, told us that career pathing is an

extension of the tremendous corporate culture that they’ve built up in their organization.

“We think it’s so important to have the right culture, and this is the next level of building our

culture,” she said.

Career pathing programs are a great way to build employee engagement, as your talent

charts its own course towards advancement.

Building an employee-first mindset

Moran added that the desire to create a great employee culture is embedded in the very fabric of the company — which provides real benefits beyond employee engagement, as well.

“We have always had this ‘employee-first’ mindset. We really feel like that’s foundational in building our culture,” Moran said. “If we can… build the culture inside or organization, which is good for our team, then that kind of flows on over to our [customers]. That overflows to the growth of the organization, which benefits everybody involved.”

First Commerce’s mindset is to empower their employees to grow, whether it’s with them or even if it’s with other organizations in their future career. That’s the kind of investment in employees that can drive true employee engagement, even during the most challenging of times.

Tackle your priorities in 2021

CompetencyCore by HRSG is HR software that's already used by many credit unions and financial institutions -- delivering the power of competencies to help them build great job descriptions, interview guides, employee development plans & career pathing programs.

Learn more today:

Submit a Comment